Project Finance

- Assistance in Developing of the Project Contracts (concession, trust, credit, emission, etc).

- Preparation of an Information Memorandum and Prospects for Potential Investors and Lenders.

- Preparation of the Different Financial Models Required by the Project.

- Coordination of the Due Diligence Process of the Potential Investors and Lenders.

- Capital Placement Including Raising Debt (“Senior Debt”, “Subordinated Debt”, “Mezzanine Debt”; “Convertibles”) and/or Equity for the Project.

- Accompaniment in the EPC Procurement Process.

- Preparation of the Necessary Financing Documents.

- Support in the Assessment, Analysis, Review and Negotiation of the Financing Contracts of the Project.

- Assistance towards the Compliance of the Conditions Precedent to Achieve the Financial Close.

Capital Markets

- Corporate Bonds.

- Asset Securitization.

- Commercial Notes.

- Initial Public Offerings.

- Advisory for the Development of the Optimal Hedge Strategy for the Transaction.

Corporate Finance

- Capital Placement (raising debt and/or equity).

- Assessment of Joint Ventures.

- Syndicated Loan Transactions.

- Debt Restructuring.

- Fairness Opinions & Valuations.

- Structuring the Transaction and Development of a General Strategy.

- Implementation of Due Diligence.

- Assessment and Valuation of the Potential Risks of the Transaction, and Analysis of Risk Mitigation Strategies.

- Financial Modeling and Valuation Process.

- Preparation of Required Documents for the Transaction (Letter of Intent).

- Assistance Throughout the Negotiation Process.

Public Sector

- Project execution analysis.

- In depth financial model with capital structure optimization and sensitivity analysis.

- Identification, assessment, and valuation of project risks.

- Value for Money Analysis, public sector comparator (CPP).

- Assistance in RFQ and RFP process.

- Support in the project commercial documents (teasers) and events (project road show).

- Accompaniment throughout selection process.

Private Sector

- Investment opportunity Analysis.

- Financial prefeasability and feasibility studies.

- Identification, assessment, and valuation of project risks.

- Value for Money Analysis, public sector comparator (CPP).

- Assistance in the conformation of consortiums and joint ventures.

OUR TEAM

Hector Ulloa —

Managing Director

Hector (Founder and President of Structure Banca de Inversión) holds a Master in Finance from Universidad de Los Andes and a Bachelor in Law from Pontificia Universidad Javeriana.

His practice includes Project Finance, Mergers & Acquisitions and Structuring infrastructure assets in Colombia, Peru, Panamá, Costa Rica, Argentina, and other Latin American countries. His most important and recent advisory service include the financial structuring of Metro de Bogota (US$4.5 billion) on behalf of the Colombian government; the acquisition of “Concesión Costera Cartagena Barranquilla”and “Concesión Pacífico Tres” on behalf of ISA; the financing of four 4G toll road projects in Colombia (US$ 1.9 Bn);Financing of power assets, such as Termonorte and TCE (transmission line) in Colombia and a Gas to Power asset in Panama. Hector has been Project Finance and International Capital Markets’ professor in multiple universities in Colombia and is the author of “Fuentes de Recursos en los Mercados Financieros Internacionales”.

Carlos Díaz Granados —

Director

Carlos holds a Master in Finance and a Bachelor in Business Administration from the School of Advanced Management Studies (“C.E.S.A.”), in Bogota, Colombia.

He has more than 9 years of experience in the investment banking industry in Project Finance and M&A’s. Carlos has also led projects of structuring, financing, and purchase/sale of companies for more than USD 6.000 million which involve resources in the traditional banking markets as well as in capital markets. Since 2011, Carlos is part of the Structure team, he has served as Director for the structuring and financing of projects such as toll roads, airports, ports, mass passenger transport systems and the energy sector in Colombia and Latin America. Among its most outstanding achievements are: (i) Financing of the 4G Project “Autopista al Mar 2”, with an estimated value of COP $ 2 trillion; (ii) Award and financing of the 4G Project “Concesión Pacífico Tres”, with an estimated value of COP $ 1,8 trillion; and (iii) the financial structuring of the Energy Transmission Line Project “La Virginia – Nueva Esperanza”.

Vanessa Villanueva —

Director

Vanessa holds a Master in Finance from Universidad de Los Andes and a Bachelor in Business Administration from the same university. Since 2015, Vanessa is part of the Structure team as a Project Director and has led projects such as the structuring and financing of the “Concesión Costera Cartagena – Barranquilla”; M&A process in the purchase of the “Concesión Costera Cartagena – Barranquilla” by ISA; financial structuring of multiple PPP airport projects; and “Primera Línea del Metro Ligero de Barranquilla”. She has also led financial structuring in Argentina, Perú, Panamá and Costa Rica. Prior joining Structure, Vanessa was Financial Manager in “Concesionaria del Desarrollo Vial de la Sabana – DEVISAB”, which is a company dedicated to the construction of civil works, road maintenance, and operation of the Chía – Mosquera – Girardot highway, focused on structuring and financial modeling of the projects of the Consortium. Before that, Vanessa was Operational and Financial Director in “Mercado y Bolsa”, a member of the Colombian Mercantile Exchange where she was responsible for the coordination and execution of the purchase and sale operations carried out by the firm and for conducting the financial review of the business, and the financial projections of the company.

Julián Marquez Aguel —

Director

Julian holds an MBA from London Business School, a Master in Economics from Universidad de Los Andes, and a Bachelor in Economics from the same university.

Prior joining Structure, Julian was Director at the Infrastructure Deal Advisory team at KPMG where he led the financial structuring of concession/PPP projects such as the First Line of the Bogota’s Metro, San Rafael Park and Cable Car Project, Cartagena Cable Car unsolicited proposal and M&A process in renewable energy, among others. Before that, Julian was external Advisor for the Inter-American Development Bank, focused on the development of private participation in the development of public infrastructure in Latin America. Previous to IADB, he was the Head of the Public-Private Partnership Unit at the National Planning Department where he led policy and regulatory changes to the PPP law, feasibility studies of infrastructure projects and approval of financial legal and technical valuation and risk allocation for 20 toll-roads (4 Generation Program), airports (Barranquilla) and fluvial navigation project (Magdalena River) for US$ 12 Bn.

Silvana Mac Allister —

Senior Analyst

Silvana holds a Bachelor degree in Business Administration and Industrial Engineering from the Universidad de Los Andes.

Silvana started working in Structure in 2016 and has been working in different projects as analyst in the infrastructure sector in Colombia and Panama. Her main focuses have been in (i) M&A of toll road concession (4 Generation Program) in Colombia, such as “Concesión Costera Cartagena – Barranquilla” and “Concesión Pacífico Tres”, and an airport concession which was “Aeropuertos del Oriente”; and (ii) financial structuring of multiple PPP unsolicited proposal: Cartagena, San Andres and Providencia, and Cali, Neiva and Buenaventura airports. Additionally, Silvana participated in the financing of a Power Generation project in Panamá.

Felice Grimoldi —

Senior Analyst

Felice holds a Master of Science in Finance degree from the University of Rochester (Rochester, NY, United States) and an Industrial Engineering degree from Universidad de Los Andes.

Felice joined Structure in 2017, where he led the financial modeling of the First Line of the Bogota’s Metro, the biggest Project Finance in Colombia. Recently, Felice led the financial structuring of the Project “Tren de Cercanias de la Sabana de Bogota” – Regiotram, which was recently awarded to China Civil Engineering Construction Corporation. Felice has also worked as financial advisor to 4G toll concession Projects and power generation and transmission companies. Prior to joining Structure, Felice worked in mergers and acquisitions of low-mid markets companies in NYC.

Iván Fandiño —

Junior Analyst

Iván holds a Bachelor degree in Industrial Engineering with an emphasis in economics from the Universidad de Los Andes.

Iván joined Structure in 2019, supporting the financing and refinancing of 4G toll concession projects, power transmission lines, and rail projects, such as the most recent Project “Tren de Cercanias de la Sabana de Bogota” – Regiotram. Ivan is in charge of the energy, metallurgical, financial and economic research, with special analysis of the advantages and disadvantages of the different debt instruments in infrastructure projects under PPP schemes.

Alejandro Peña —

Junior Analyst

Alejandro holds a Bachelor degree in Industrial Engineering with an emphasis in finance and economics from the Universidad de los Andes.

Alejandro joined Structure in 2020 and has supported the implementation of Value for Money methodology and the risk valuation for infrastructure projects under the PPP scheme. Alejandro also conducts research on financial markets, multiple industries, and applicable laws and regulations for infrastructure projects in Colombia.

RANKING

Financial Advisors Ranking in Colombia

(June 2010 - June 2020) – Number of Transactions

No. | Company | Transactions |

|---|---|---|

1 | Structure Banca de Inversión | 13 |

2 | Bonus Banca de Inversión

| 9 |

3 | Banco BTG Pactual

| 6 |

4 | Bancolombia

| 5 |

5 | Deloitte

| 4

|

6

| Inverlink

| 4 |

7 | Goldman Sachs

| 3 |

8 | BNP Paribas

| 2 |

9 | Corficolombiana

| 2 |

10 | Sumitomo Mitsui Banking Corporation

| 2 |

Financial Advisors Ranking in Colombia

(June 2010 - June 2020)– Total Value

No. | Company | Total (USD M) |

|---|---|---|

1 | Structure Banca de Inversión | 6,361 |

2 | Bonus Banca de Inversión | 6,145

|

3 | Bancolombia | 3,605

|

4 | Deloitte

| 2,379

|

5 | Banco BTG Pactual

| 2,230

|

6 | BNP Paribas

| 1,874

|

7 | Goldman Sachs

| 1,862

|

8 | Corficolombiana

| 1,841

|

9 | Sumitomo Mitsui Banking Corporation

| 1,649

|

10 | Inverlink

| 1,509

|

We are ranked as leading financial advisors in the colombian infrastruture sector.

As a financial advisor, Structure has raised more than US$ 5.000 million in debt for infrastructure projects including operations with local commercial banks, development banks, international capital markets (Rule 144A/Reg S) and private equity funds. Structure has vast experience with the biggest international commercial and investment banks.

Top: 1

AWARDS

Primera Línea del Metro de Bogotá was awarded Gold Winner as the Best Transit Project by P3 Awards in 2020.

According to P3 Awards:

“The First Line of the Bogotá’s Metro is a project that surprised the judges due to its complexity and its excellent financial structure. In addition, it takes place in one of the most congested cities in the world, which will help make life easier for Bogota citizens.»*

* Source: www.metrodebogota.gov.co

“The way in which the planning of a financial structure unites with the needs of the citizenry, taking into account that it will move more than one million passengers per day, creating a revolutionary transport option for Bogota».**

** Source: www.bogota.gov.co

Structure acted as financial advisor for Empresa Metro de Bogotá

Structure acted as financial advisor for Empresa Metro de Bogotá

2020

Best Transit |Project

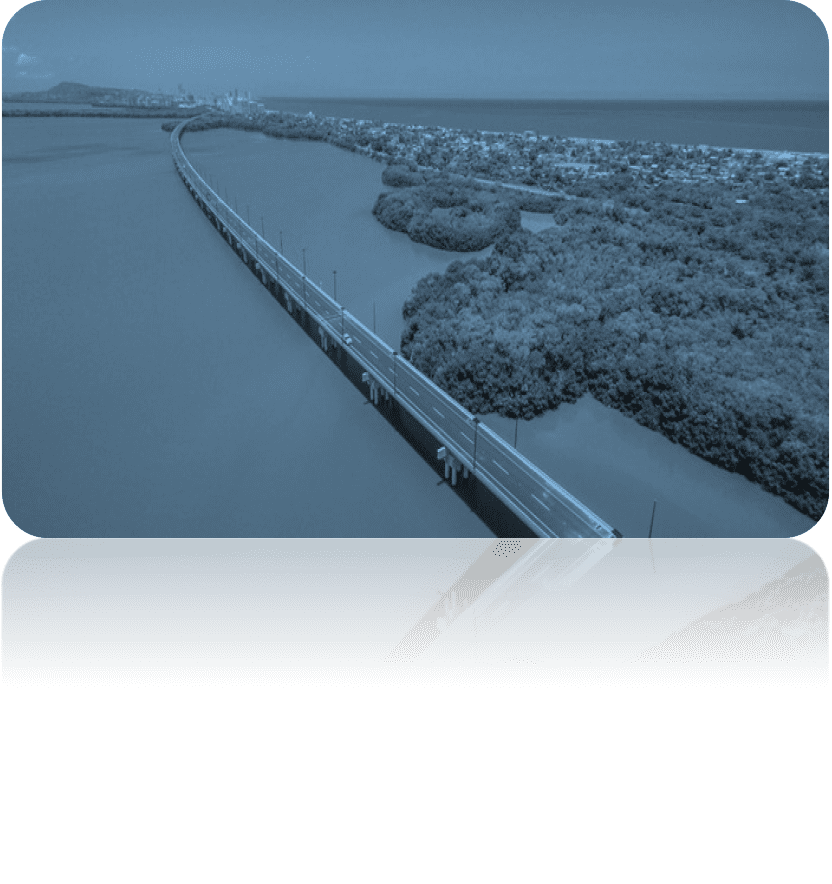

Concesión Costera Cartagena Barranquilla won the “2020 Latin American Transport Deal of the Year” granted by Project Finance International (PFI).

Concesión Costera Cartagena Barranquilla :

The concession has also been recognized with other awards such as the Pan American Prize for Sustainable Development, the National Engineering Prize and the National Environmental Prize, among others, for its minimal intervention on the Mangrove and minimal occupation of the Ciénaga.

“This road project has also generated a reduction in travel times, a reduction in operating costs associated with public transport, strengthening tourism and economic development in the area of influence, as it employs about 1,052 people from the region”.*

* Source: www.ani.gov.co

Financial Advisory for the Purchase of the Concession

Financial Advisory for the Purchase of the Concession

2020

Latin American Transport Deal of the Year

Structure acted as financial advisor for the transaction.

According to the magazine:

“Goldman Sachs and local investment bank Structure arranged a unique package to fund the highway concession, putting together the equivalent of $650 million in long-term financing through a combination of bank loans and bonds. The elaborate arrangement makes Pacífico 3 a clear choice for Best Infrastructure Financing: Andes and Best Road Financing.”

“The cheapest tranche in the financing package was the UVR bond, which was priced with a 7% coupon to yield 7.8%. The other UVR-denominated debt, a loan from the Credicorp-Sura fund, carried a rate of 7.5% over the inflation-linked units, while the dollar bond priced with an 8.25% coupon to yield 8.5%.”

Best road financing

Pacífico 3-2016

Concesión Pacífico 3 also won “2016 Latin American Deal of the Year” granted by Project Finance International (PFI).

According to the magazine:

“A number of key factors (…) allowed banks, like Goldman, to get comfortable with lending to the deal (…), Goldman was saying to the market that the projects were bankable and that it would be willing to make a US$ 1,2bn bet on that fact. Structure Banca de Inversion was acting as financial adviser to the sponsors and Goldman Sachs was tapped as global co-coordinator and lead arranger for the financing efforts.”

“The Proceeds of the US dollar bonds, UVR bonds and peso A and B loans will be used by the project company to pay for all financing-related expenses, pre-fund all the required accounts – including the debt services reserve accounts (DSRAs) and O&M reserve accounts (OMRA) – and finance a portion of the total project cost.”

* Source: PFI Yearbook 2017.

2016

Latin American Deal

of the Year

Bogotá’s Metro

Metro Line

Financial Structuring of Bogotá’s Metro

Project Description:

It focuses mainly on the Financial Structuring for the First Line of the Bogotá’s Metro, which covers approximately 24 km and is set to have 15 stations, 10 of which will have an integration system with TransMilenio. It also include the construction and procurement of the rolling stock.

Contract Structure:

27-year concession structured under Law 80 of 1993. (DFBOMT).

Graniting Entity:

Empresa Metro de Bogotá - EMB.

Estimated CAPEX:

COP$ 12,9 billon (US$ 4,3 billion). – Constant December 2017.

The value of the contract is COP$ 13,8 billion (US$ 4,62 billion).

Estimated CAPEX:

COP$ 12,9 billon (US$ 4,3 billion). – Constant 2017.

The value of the contract is COP$ 13,8 billion (US$ 4,62 billion).

Graniting Entity:

Empresa Metro de Bogotá - EMB.

Structure’s Role:

Structure BI

was appointed by FDN as Financial Advisor for the Financial Structuring of Bogotá’s Metro Project.

After a prequalification process with 6 participants, only 2 submitted economic proposals. As a result, the China Harbour Engineering Company Limited and Xi’an Metro Company Limited consortium was awarded the Project.

Ruta del Sol – Sectors I, II & III

Road Infrastructure

Financial Structuring of the 3 Sectors of Ruta del Sol

Project Description:

It connects Bogotá with the Caribbean Coast by developing a new doble roadway and improving the existing road corridors between Villeta (Cundinamarca) and Ciénaga (Magdalena) municipalities.

1,082 km divided into 3 different sectors (independent contracts).

Contract Structure:

Concession structured under Law 80 of 1993.

Estimated Value of the Contract:

Sector 1: COP $962.000 million (US$ 500,24 million).

Sector 2: COP$ 2,09 billion (US$ 1,09 billion).

Sector 3: COP $2,08 billion (US$ 1,08 billion).

Granting Entity:

National Infrastructure Agency - ANI.

Estimated Value of the Contract:

Sector 1: COP $962.000 million (US$ 500,24 million).

Sector 2: COP$ 2,09 billion (US$ 1,09 billion).

Sector 3: COP $2,08 billion (US$ 1,08 billion).

Granting Entity:

National Infrastructure Agency - ANI.

Structure’s Role:

Between 2009 and 2010, Structure BI was appointed by the IFC for the financial structuring of the 3 sectors of the Ruta del Sol Project.

Corredores Arteriales de la Competitividad

Road Infrastructure

Financial Structuring of 17 Road Corridors of the “Corredores Arteriales de la Competitividad” Program

Project Description:

It is a group of road corridors located in different regions of the country that aimed to optimize the mobility, connectivity, production and merchandising among several Colombian regions.

It comprises a total of 19 road corridors with a total length of 1.650 km.

Contract Structure:

Most of the road corridors were structured as concessions.

Estimated CAPEX:

COP $2,5 billion (US$ 1,2 billion).

Granting Entity:

The National Roads Institute (INVÍAS - Instituto Nacional de Vías).

Structure’s Role:

Structure BI was appointed by INVÍAS as Financial Advisor for the financial structuring of 17 corridors of the program.

Panamá’s Metro

Metro Line

Financial Structuring of Panamá's Metro

Project Description:

The Project focuses mainly on the Financial Structuring for the First Line of the Panama´s Metro, which covers approximately 16 kilometers and its main function is to connect the bus terminal station, in Albrook, with the San Isidro station in the north of the metropolitan area of the city of Panama.

Contract Structure:

Concession.

Estimated CAPEX:

COP$ 2,8 billion (US$ 1,45 billion).

Granting Entity:

Metro de Panamá.

Structure’s Role:

Structure BI was appointed as Financial Advisor by Cal & Mayor and Poiry for the financial structuring of the First Line of the Metro in Panama under the contract “Integrator Assessor of the Metro System in Panama” with the IDB and CAF.

Rafael Núñez International Airport

Airports

Financial Structuring of Cartagena´s Airport Unsolicited Proposal-PPP

Project Description:

It focuses mainly on the expansion of the current airport in Cartagena.

The project is going through the viability process with the Agencia Nacional de Infraestructura (“ANI”).

Contract Structure:

8,5-year Unsolicited Proposal PPP structured under Law 1508 of 2012.

Estimated CAPEX:

COP$ 500.000 million (US$ 150 million).

Graniting Entity:

National Infrastructure Agency - ANI.

Sponsors (SACSA):

AENA Corficolombiana Terpel

Structure’s Role:

Structure BI has been mandated by SACSA as Financial Advisor for the financial structuring of the Project.

Sur Occidente Airports

Airports

Financial Structuring of the Unsolicited Proposal-PPP of 3 Airports

Project Description:

It focuses mainly on the expansion operation and maintenance for the International Airport of Alfonso Bonilla Aragón in Cali, as well as the National Airports of Benito Salas in Neiva and Gerardo Tobar López in Buenaventura.

Contract Structure:

30-year Unsolicited Proposal PPP structured under Law 1508 of 2012.

Estimated CAPEX:

COP$ 893.000 million (US$ 300 million).

Granting Entity:

National Infrastructure Agency - ANI.

Sponsors (Aerocali):

AENA Corficolombiana

Structure’s Role:

Structure BI has been mandated by the Concessionaire and the Sponsors as Financial Advisor for the financial structuring of the Project.

Aerocivil

Airports

Structuring of the Concession of 6 Airports in Colombia

Project Description:

It consists of the financial, legal and technical structuring and implementation of the integration and concession process of José María Córdova Airport in Rionegro and Olaya Herrera Airport in Medellín. Also involves the execution of an study that determines the financial, legal and technical feasibility to include in the concession, Los Garzones Airport in Montería, Caraño Airport in Quibdó and Antonio Roldan Airport in Carepa.

Contract Structure:

Concession structured under Law 80 of 1993.

Estimated CAPEX:

COP$ 780.000 million (US$ 390 million).

Granting Entity:

Aeronautica Civil.

Structure’s Role:

In December 2006, Structure BI was awarded by Aeronautica Civil for the financial, legal and technical Structuring for the process of integration and concession of the mentioned Colombian airports.

San Andrés and Providencia Airports

Airports

Financial Structuring of the San Andrés and Providencia Airports Unsolicited Proposal-PPP

Project Description:

It consists in the expansion, operation and maintenance of two Colombian airports:

Gustavo Rojas Pinilla Airport on the San Andrés Island; and

El Embrujo Airport on the Providencia Island.

Contract Structure:

30-year Unsolicited Proposal PPP structured under Law 1508 of 2012.

Estimated CAPEX:

COP$ 262.000 million (US$ 80 million).

Granting Entity:

National Infrastructure Agency - ANI.

Sponsors:

SP Ingenieros.

Structure’s Role:

Structure BI has been mandated by the Concessionaire and the Sponsors as Financial Advisor for the financial structuring of the Project, which within the schedules, it is expected to be awarded in 2021.

Concesión Autopistas de Urabá

Road Infrastructure

Financial Advisory for the Financial Close

Project Description:

The “Autopista al Mar 2” project consists of the construction, rehabilitation, improvement, operation and maintenance of 253,9km, connecting the cities of Cañasgordas, Uramita, Dabaeiba, Mutatá, El Tigre and Necoclí.

Contract Structure:

25-year PPP structured under Law 1508 of 2012.

Financial Close:

COP$ 2,1 billion (US$ 700 million).

Leders

Senior Lenders: China Development Bank, FDN and Sumitomo Mitsui Banking Corporation.

Transaction Structure:

The financial close was achieved through a senior USD loan agreement and a senior COP loan agreement.

Structure’s Role:

In 2016, Structure BI was appointed by the Concessionaire and the Sponsors as Financial Advisor for the financial structuring of the senior debt of the Project.

Concesión Costera

Road Infrastructure

Financial Advisory for the Financial Close

Project Description:

The Project’s main purpose is to design, construct, improve, maintain, operate and exploit the toll road that will connect Cartagena, Colombia’s fifth largest city by population, and Barranquilla, the largest city and port in the northern Caribbean region of Colombia.

The Project has an estimated length of 146,6 km, divided into 6 Functional Units and comprising two sections, Cartagena – Barranquilla section (FU1 – FU4) and Prosperidad del Atlántico section (FU5 - FU6).

Contract Structure:

25-year PPP structured under Law 1508 of 2012.

Financial Close:

COP $1,45 billion (US $497 million).

Lenders:

Senior Lenders: Goldman Sachs (underwriter), Bancolombia, Banco de Bogotá, CAF-AM Ashmore I, Banco de Occidente, and FDN.

Transaction Structure:

The financial close was achieved through a senior USD loan agreement, a senior COP loan agreement and the issuance of bonds denominated in UVR and USD.

Structure’s Role:

Structure BI was the Financial Advisor of the consortium for the proposal submission and the structuring of the financing in order to achieve the financial close. As a result, the contract was awarded to our clients and the financial close was successfully achieved.

Concesión Pacífico Tres

Road Infrastructure

Financial Advisory for the Financial Close

Project Description:

The “Concesión Pacífico Tres” has an estimated length of 145 km, divided in 5 Functional Units, and goes trough the Colombian departments of Antioquia and Caldas. The Project improves the connectivity of the country's production centers including Antioquia, Eje Cafetero and Valle del Cauca with the port of Buenaventura.

Contract Structure:

25-year PPP structured under Law 1508 of 2012.

Financial Close:

COP$ 2,2 billion (US$ 750 million).

Lenders:

Senior Lenders: Bancolombia, Banco Corpbanca Colombia, Credicorp Capital – Sura Asset Management and FDN.

Transaction Structure:

The financial close was achieved through a senior USD loan agreement, a senior COP loan agreement and the issuance of bonds denominated in UVR and USD.

Structure’s Role:

Structure BI was the Financial Advisor of the consortium for the proposal submission and the structuring of the financing in order to achieve the financial close. As a result, the contract was awarded to our clients and the financial close was successfully achieved.

Concesión Alto Magdalena

Road Infrastructure

Financial Advisory for the Financial Close

Project Description

The Honda – Puerto Salgar – Girardot project is the first Colombian toll road that is part of the first wave of the 4G concession program.

It aims to connect the south of the country to the north by improving the already existing road that connects to Ruta del Sol. The new road will give the south of the country access to the ports of Cartagena and Barranquilla (the Caribbean).

Contract Structure:

25-year PPP structured under Law 1508 of 2012

Estimated Operation Value:

COP $1,05 billion (US$ 360 million).

Lenders:

Senior lenders: CABEI, Banco de Bogotá, Banco AV Villas, Banco de Occidente and Banco Popular.

Transaction Structure:

The financial close was achieved through a senior USD loan agreement and a senior COP loan agreement.

Structure’s Role:

Structure BI was the Financial Advisor of the consortium for the proposal submission and the structuring of the financing in order to achieve the financial close. As a result, the contract was awarded to our clients and the financial close was successfully achieved.

La Virginia – Nueva Esperanza

Energy

Financial Advisory for the Financial Close

Project Description:

Transmisora Colombiana de Energía S.A.S. E.S.P. was awarded with the design, construction, operation and maintenance of the Project “La Virginia - Nueva Esperanza”, which consists in a 240 km power transmission line that runs through the departments of Risaralda, Caldas, Tolima, and Cundinamarca.

Expected Annual Income:

Under Resolution CREG 015 of 2017, the Expected Annual Income for the first 25 years of operation of the project is US$ 22.498.000 (December 2015), beginning on December 1, 2021.

Financial Close:

COP$ 613.000 million (US$ 163,5 million)

Lenders:

Senior lenders: MUFG (MLA), Banco Sabadell.

Transaction Structure:

USD Mini-Perm during construction period.

Structure’s Role:

In 2019, Structure BI was appointed as Financial Advisor to raise debt for the Project.

Termonorte

Energy

Structuring and Financing of the Senior Debt Facilities for Termonorte Power Plant

Project Description:

In January 2012 the Comisión de Energía y Gas (CREG) launched an auction (CREG Resolution: 056 - 2011) and granted Termonorte a Firm Energy Obligation. Termonorte have an installed capacity able to provide energy to the National Interconnected System (Grid), equivalent to 93 MW.

Contract Structure:

Termonorte has been awarded a reliability charge for a 20 years term.

Financial Close:

COP$ 236.000 million (US$ 80,6 million).

Lenders:

Stabilis Capital Management.

Transaction Structure:

The financial close was achieved through a senior USD loan agreement (Bridge loan).

Structure’s Role:

Structure BI was mandated as Financial Advisor for the financial structuring and financing of its senior debt.

Western Regiotram Project

Rail

Structuring and Financing of the Senior Debt Facilities for the Western Regiotram Project

Project Description:

It is expected to connect the municipalities of Facatativá, Madrid, Mosquera and Funza (located in the state of Cundinamarca) with Bogotá by the rehabilitation of the existing railway line and the construction of new railway line as required.

Contract Structure:

27,5-year concession structured under Law 80 of 1993.

Financial Close:

On going.

Lenders:

On Going.

Transaction Structure:

On Going.

Structure’s Role:

Structure BI was mandated by CCECC to act as Financial Advisor of the consortium for the proposal submission and the structuring of the financing in order to achieve the financial close.

The contract was awarded to our clients on December 23, 2019, and the financial close is on going.

Concesión Alto Magdalena

Road Infrastructure

Financial Advisory for the Refinancing of the Project

Project Description

The Honda – Puerto Salgar – Girardot project is the first Colombian toll road that is part of the first wave of the 4G concession program.

It aims to connect the south of the country to the north by improving the already existing road that connects to Ruta del Sol. The new road will give the south of the country access to the ports of Cartagena and Barranquilla (the Caribbean).

Contract Structure:

25-year PPP structured under Law 1508 of 2012.

Estimated Operation Value:

COP$ 1,77 billion (US$ 507 million).

Lenders:

Senior lenders: MUFG, SMBC, BlackRock, CAF-Ashmore, Banco de Bogotá and FDN.

Transaction Structure:

The financial close was achieved through two Mini-perm (one denominated in USD and the other in COP) and two Fully Amortizing tranches, both denominated in COP.

Structure’s Role:

In 2019, Structure BI was mandated to structure a refinancing and recap of the senior debt of the Project.

This is the first 4G project to accomplish a refinancing and a recap.

Desarrollo Vial de Medellín S.A.

Road Infrastructure

Financial Advisory for the Refinancing of the Project

Project Description:

This concession entails the design, construction, rehabilitation, and operation and maintenance of the national road network in eastern Medellín and Rionegro Valley, including the operation and maintenance of the Santuario – Glorieta Caño Alegre sector of the Medellín – Bogotá roadway.

The entire project has a total estimated length of 347,95 km, and the first sector 102 km.

Contract Structure:

Concession structured under Law 80 of 1993.

Estimated Operation Value:

COP$ 598.000 million (US$ 184 million).

Lenders:

Senior lenders: Bancolombia.

Transaction Structure:

The financial close was achieved through a senior COP loan agreement.

Structure’s Role:

In 2018, Structure BI was mandated to structure a refinancing and recap of the senior debt of the Project.

Concesión Pacífico Tres

Road Infrastructure

Financial Advisory for the Purchase of the Concession

Project Description:

The “Concesión Pacífico Tres” has an estimated length of 145 km, divided in 5 Execution Units, and goes trough the Colombian departments of Antioquia and Caldas. The Project improves the connectivity of the country's production centers including Antioquia, Eje Cafetero and Valle del Cauca with the port of Buenaventura.

Estimated Operation Value:

25-year PPP structured under Law 1508 of 2012.

Estimated Financial Close:

On going.

Transaction Structure:

On Going.

Structure’s Role:

In 2019, Structure BI acted as Financial Advisor for the purchase of the concession.

Concesión Costera

Road Infrastructure

Financial Advisory for the Purchase of the Concession

Project Description:

The Project’s main purpose is to design, construct, improve, maintain, operate and exploit the toll road that will connect Cartagena, Colombia’s fifth largest city by population, and Barranquilla, the largest city and port in the northern Caribbean region of Colombia.

The Project has an estimated length of 146,6 km, divided into 6 Functional Units and comprising two sections, Cartagena – Barranquilla section (FU1 – FU4) and Prosperidad del Atlántico section (FU5 - FU6).

Contract Structure:

25-year PPP structured under Law 1508 of 2012.

Estimated Operation Value:

COP$ 2 billion (US$ 516 million).

Transaction Structure:

Buyer: Interconexión Eléctrica (ISA).

Seller: Colpatria, Mario Huertas Cotes, Constructora Meco, Castro Tcherassi.

Structure’s Role:

In 2019, Structure BI acted as Financial Advisor for the purchase of the concession.

Generadora Luzma

Energy

PCH Luzma Fairness Opinion

Project Description:

Generadora Luzma is a Small Hydroelectric Plant (PCH) which began operations in September 2017. The Company has 2 generators (Luzma 1 and 2) with an installed capacity of 19,9 MW each.

The Project will take advantage of the waters of the Riachón River in its middle and lower basin, which is part of the Porce River basin for the generation of electric power and its distribution through the installation and operation of three lines at 110kV.

Estimated Operation Value:

Undisclosed.

Transaction Structure:

Undisclosed.

Structure’s Role:

In 2019, Structure BI was mandated by Generadora Luzma, to give its Fairness Opinion about the company’s value.

Neiva – Girardot

Road Infrastructure

Financial Advisory for the Purchase of the Concession

Project Description:

Its main purpose is to improve the connectivity between Huila and Tolima states, and enhancing the connectivity of the middle country regions.

The roadway is part of the 800 km corridor between Bogotá and Colombia-Ecuador border, and it connects the Girardot – Honda – Puerto Salgar and Girardot – Ibagué – Cajamarca concessions, and the National Route 40 with the National Route 45.

Contract Structure:

25-year PPP structured under Law 1508 of 2012.

Estimated Operation Value:

Indicative Bids.

Transaction Structure:

Buyer: Globalvia.

Seller: CSS Constructores - Solarte Solarte, ALCA.

Structure’s Role:

In 2014, Structure BI acted as Financial Advisor for the purchase of the concession.

EXPERIENCE

Road Infrastructure

2019

Financial Advisor for the financing of the 4G Project “Autopista al Mar 2”.

2016

Financial Advisor for the financing of the 4G Project “Concesión Pacífico 3”.

2016

Financial Advisor for the financing of the 4G Project “Cartagena - Barranquilla”.

2016

Financial Advisor for the financing of the 4G Project “Girardot - Honda - Puerto Salgar”.

2015

Financial Advisor on the bidding process for the 4G Project “Puerta de Hierro - Cruz del Viso”.

2015

Financial Advisor on the bidding process for the 4G USD 435 M. Project “Mar 1”.

2015

Financial Advisor on the bidding process for the 4G Project “Rumichaca - Pasto”.

2010

Financial Structuring of the Project “Ruta de las Américas - Sector I”.

2010

Financial Structuring of the Project “Ruta del Sol - Sector III”.

2010

Financial Advisor for the Project “Armenia - Pereira - Manizales y Calarcá - La Paila”.

2010

Financial Re-Structuring of the Project “Desarrollo Vial de la Sabana”.

2010

Financial Re-Structuring of the Project “Troncal del Tequendama”.

2009

Financial Structuring of 17 toll roads of the program “Corredores Arteriales de la Competitividad”.

2009

Financial Structuring of the Project “Ruta del Sol - Sector II”.

2009

Financial Structuring of the Project “Ruta del Sol - Sector I”.

2009

Financial Advisor for the Project “IRSA Sectores 1 y 5”.

Rails, Subways and Airports

2019

Financial Structuring of the Project “Primera Línea del Metro de Bogotá”.

On Going

Financial Structuring of the Project “Tren de Cercanías de la Sabana de Occidente - RegioTram”.

2010

Financial Structuring of the Project “Primera línea del Metro de Panamá”.

On Going

Financial Structuring of the Project “Primera Línea del Metro de Barranquilla”.

On Going

PPP financial structuring of the southwest Colombian airports. Cali, Neiva and Buenaventura.

Aeropuertos de San Andres y Providencia

PPP financial structuring of the unsolicited proposal to intervene the “Gustavo Rojas Pinilla” Airport in the San Andrés Island.

On Going

PPP financial structuring of the investment, operation and improvement of the International Airport “Rafael Núñez”.

2010

Financial Advisors in the concession contract renegotiation for the International Airport “Rafael Núñez”.

Aeropuertos de Rionegro, Medellín, Quibdó, Carepa y Corozal

PPP financial, legal and technical structuring of six airports (Concesión Centro Norte) in Colombia.

Energy and Oil & Gas

2020

Financial advisor in order to raise debt for the Project “Línea de Transmisión de Energía La Virginia – Nueva Esperanza 500 kV”.

On Going

Financial Advisor in order to raise debt for the Project SSE Sinolam Smarter Energy in Panama. LNG Storage and Regasification Terminal.

2019

Valuation of the Project.

2018

Financial Structuring of the Project “Termonorte”.

2017

Financial Structuring of the Project “Aguaytía-Pucallpa 138 kV (segundo circuito) – Perú”; 260 km.

2017

Financial Advisor for the purchase and financing of “Petroeléctrica de los Llanos”; 260 km.

2016

Financial Advisor for the purchase of PPG – Pacific Power Generation.

2015

Financial Advisor for financial, tax and accounting issues related to the EPC Contract signed with Puerto Cayao.

2014

Financial Advisory for the structuring and financing of LNG power generation agreements.

2014

Execution of the financial model for SMBC for the structuring and financing for the first regasification plant built in Colombia.

2014

Financial Advisor for the sale of Sopesa (San Andrés Island).

2014

Financial Structuring of a Thermo Generation Plant (BOT) – 10 MW.

2013

Financial Advisor for the purchase of an energy company in Colombia.

CLIENTS